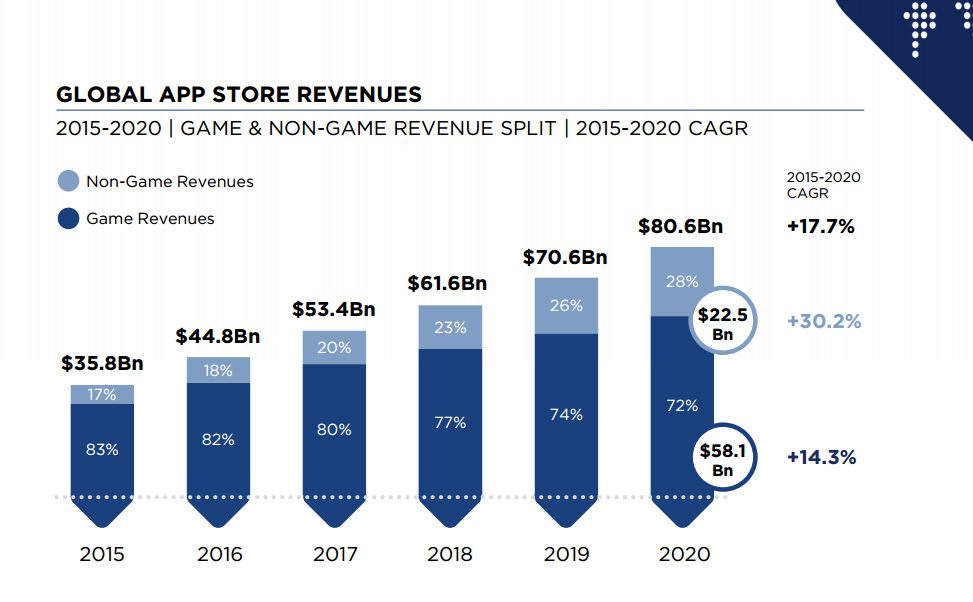

Newzoo Reports Games Will Account For 82% Of $44.8 Billion App Market By 2020

Market research firm Newzoo shows the money generating power of mobile games in its global mobile market report: 82% of the $44.8 Billion app market is games. The numbers are staggering. Now do you see why developers want to corner their own segment of the mobile population?

Here are the basic highlights for those of you with too much internet browsing to do:

- 35% of World's Active Mobile Devices in July were Apple, 23% are Samsung

- Global app revenues will reach $44.8 billion in 2016 and grow to $80.6 billion by 2020

- Chinese brands account for seven of the top ten global mobile brands

- 79% of tablets used in the US are models from before 2013. The drop in “units shipped” sends the wrong message to app developers.

- There are 2.3 billion smartphone users worldwide

Newzoo predicts the mobile market will nearly double to $80.6 billion by 2020, but mobile should account for less of the pie (from 82% to 72%).

Guess where the number one app market is.

China.

China is expected to spend $11.9 billion on apps by the end of the year while the United States accounts for $9.2 billion. The nation makes up 30.2% of all mobile devices around the world. I expect India to catch up to China sooner than later.

"Increasing internet and smartphone penetration in developing market is the underlying driver of high overall revenue growth."

Non-game apps are becoming increasingly popular as entertainment, music, and social services (dating) on mobile are normalized, increasing a willingness to spend; and people increasingly use quality of life apps such as mobile banking over traditional systems.

North America's growth is projected to jump to $15.2 billion in 2020, from $8.8 billion in 2015—below average compared to global market estimates. At the same time, gaming's overall hold on the NA market will decrease from 75.1% to 56.9%, as paying for services such as Netflix and HBO Now corners more of the overall paying app market. Plus, many younger users, including myself, are abstaining from broadcast television services in favor of streaming platforms (cord-cutting).

Keep in mind, North America is already entrenched by smartphones. Overall growth is tied to nations with populations not already connected. It's safe to say that one of these days the global market will stabilize and we won't see such huge gains year-over-year forever, but that may be some time away.

The United States and China are the biggest app markets, one's got the cash to burn and the other's got numbers. But China now casts a shadow, having surpassed the US in total app revenue in 2015. Games revenue in China is expected to continue growing.

If you follow the site you'll know there's almost always a new Chinese game coming out, which helps explain why 79% of China's overall app revenue in 2020 will be from games (projected $14.9), while the US is expected to fall from 72% in 2016 to only 57% by 2020. Again, this comes down to consumer willingness to spend on other apps, such as entertainment and social services.

When you look at the numbers it's no surprise that many developers are refocusing their efforts on the mobile market.

We expect mobile to become the dominant payment method in the not-too-distant future, whether through the technology of an established tech or payments processing titan or some as of yet little known FinTech startup.

The report features some fun metrics regarding apps in general:

- More apps are downloaded on Thursday, Friday, and Saturday.

- Switzerland has the highest conversion rate on both iOS and Adnroid, whereas the Philippines has the lowest on iOS and Argentina on Android.

And what would a mobile market report be without Pokémon Go? "Niantic Labs’ game has accrued more than 550 million installs and $470 million in gross revenues (including app store fees) in its first 82 days since launch." Nearly one in four smartphone or tablet users installed the AR game, still accruing nearly 700,000 new downloads every day.

The most interesting fact about the Pokémon GO player base is that it appears to be a broadly traditional gaming audience, despite its newness. After players of the regular Pokémon franchise, Dota 2 gamers are most likely to be playing Pokémon GO (80%), while Candy Crush Saga gamers are the least likely (46%).

It's unlikely we'll see something as widespread as GO for some time. It tapped into the franchises inordinate influence, crossing genders and generations.

I didn't cover everything featured in Newzoo's Global Market Report and it's well worth reading if you enjoy scouring data for insights. You can download a copy of the report for free by visiting Newzoo's website.

And if you love data watch our Financial Look of NCSoft below—the company behind Lineage, Blade & Soul, Guild Wars, Aion, and WildStar.