Krafton Posts Record First-Half Revenue as PUBG Keeps Delivering

Korean publisher Krafton just closed the first half of 2025 with its best numbers to date. The studio behind PUBG: Battlegrounds reported revenue of KRW 1.54 trillion (about USD 1.18 billion) and operating profit of KRW 703 billion. Both figures mark double-digit growth year-over-year, underscoring how the now-seven-year-old battle-royale continues to bankroll the company while new projects line up for launch.

PUBG became a breakout hit on PC in 2017 and later went free-to-play, a move that reinvigorated player counts. The mobile edition, PUBG Mobile, has been especially strong in Asia, and Krafton’s localized Indian release, Battlegrounds Mobile India, has helped the firm maintain a foothold in the world’s fastest-growing smartphone market.

By the numbers

- PC revenue: KRW 543.2 billion, buoyed by new progression systems like the April “Contender” upgrade track in PUBG: Battlegrounds.

- Mobile revenue: KRW 960 billion, driven by high-engagement cosmetics such as progressive “X-Suit” skins.

- Console and other platforms: KRW 33 billion, a relatively small slice of the pie but an area Krafton says it wants to expand.

- Second-quarter alone: KRW 662 billion in revenue and KRW 246 billion in operating profit.

What’s next

- PUBG collaborations with Bugatti and K-pop group aespa are planned for later this year to keep the live-service pipeline moving.

- PUBG: Blindspot, a top-down tactical shooter, will get its first public showing at Gamescom in August.

- Project Black Budget, an extraction shooter, is headed for a closed alpha before year-end. Krafton aims to take a stab at the genre made popular by Escape from Tarkov.

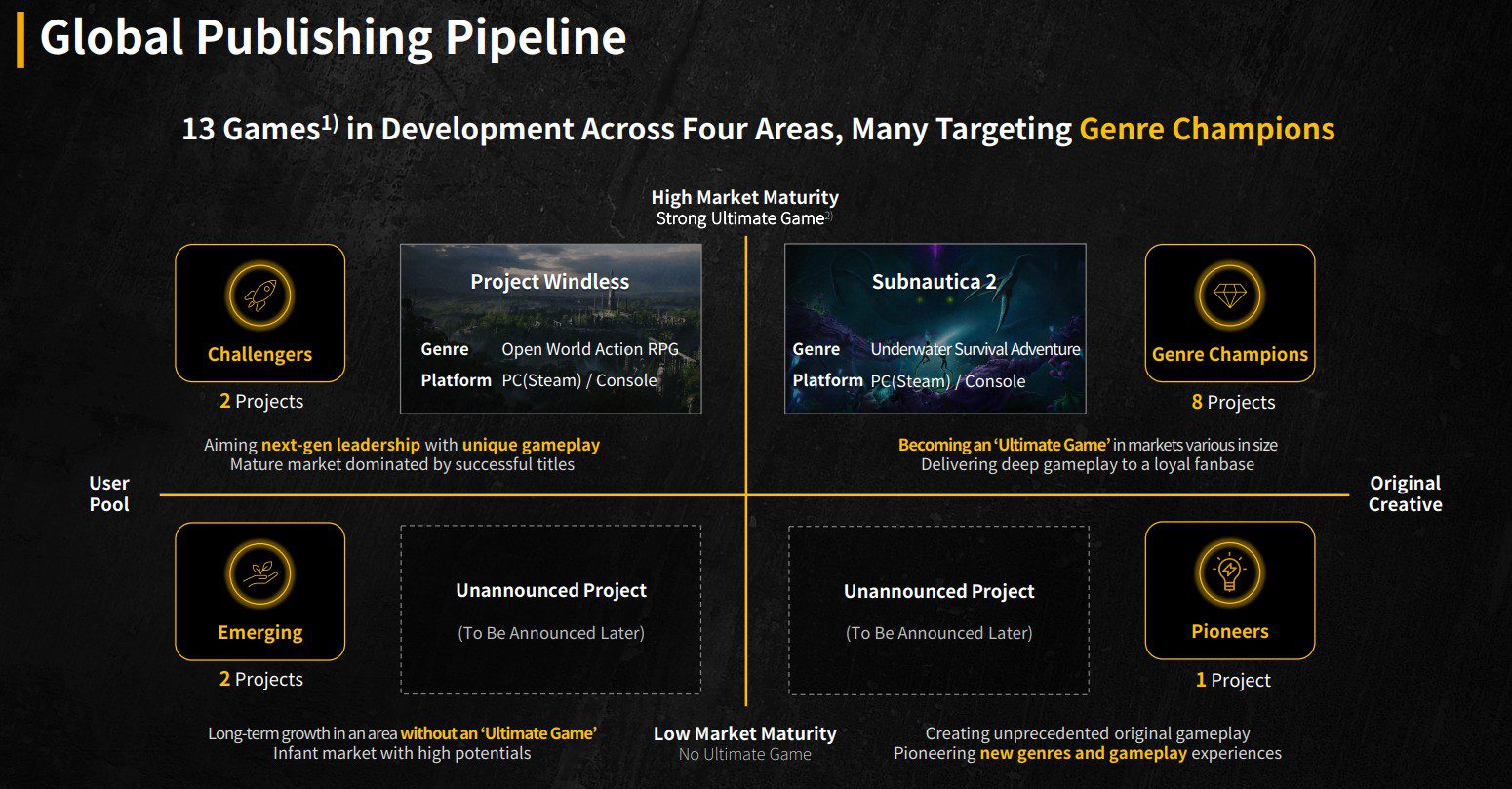

- Krafton has 13 new games in development as part of a five-year plan to cultivate fresh IP.

- The publisher’s fledgling inZOI life-sim has already topped a million sales worldwide, making it the fastest-selling Korean premium game on record.

- Krafton acquired U.S. studio Eleventh Hour Games, the team behind action-RPG Last Epoch, adding another established IP to its roster.

- The company is investing in AI research, unveiling an LLM testing benchmark called Orak and co-developing new post-training methods with SK Telecom.

- Recent moves into ad-tech include taking over Korean firm Neptune and a strategic stake in Japan’s ADK Group, known for its anime partnerships.

Krafton also highlighted Inzoi's sucess with it being the fastest selling South Korean 'package game' (buy to play).

Further reading: Q2 Investor Presentation